Your Guide on How to Download 1099 Form: A Process Simplified

It’s almost that time of the year again. The tax season is fast approaching, and as a mathematician or statistician, you may be in charge of managing your finances or perhaps those of your clients. You’ve had an epiphany; you need to download a 1099 form but are unsure how to go about it. This article was created with you in mind: let me guide you on how to download 1099 form step by step.

Anecdote: The Mathematician’s Tax Trouble

A renowned mathematician, despite his expertise in numbers and complex equations, found himself in a peculiar predicament during the tax season. He required a 1099 form but couldn’t figure out where to get one. Eventually, he solved this real-life puzzle not through advanced calculus or linear algebra, but rather by learning the fundamentals of the IRS’s digital system. This article is inspired by that situation and aims to help you avoid such complications.

The Purpose of the 1099 Form

Before we delve into the process of downloading a 1099 form, let’s understand its relevance. In simple terms, a 1099 form reports income from self-employment earnings, interest and dividends, government payments, and more. If you’re an independent contractor, freelancer, or a business owner, you’re likely familiar with this form.

Generating the Context: What is a 1099 Form?

Here’s a scenario from a software engineer’s perspective: Imagine the 1099 form as a program that executes a specific task in the tax-paying software system. It communicates with the larger system (the IRS) about a unique operation (your non-wage earnings). Just as certain function calls are integral to a program’s operation, submitting a 1099 form is indispensable for accurately reporting specific types of income during tax-season.

How to Download 1099 Form: Breaking Down the Steps

Let’s demystify the process by breaking it down the way you would an intriguing mathematical problem or a complex piece of code.

1. Go to IRS.gov: Open your web browser and type https://irs.gov/ in the address bar. This is the official website of the Internal Revenue Service (IRS), the U.S.’s tax collection agency, and the most trustworthy source for tax-related forms.

2. Navigate to Forms & Instructions: Once on the site, look for a navigational link titled ‘Forms & Instructions’. It’s typically located in the top menu bar. Click on it.

3. Search for the 1099 Form: You’ll be directed to a new page with a search bar. Type “1099 form” into the search bar, then press “Enter”.

4. Find the Correct 1099 Form: You’ll see several links corresponding to different versions of the 1099 form. Each has a unique purpose and, like mathematical models, must be chosen carefully to suit your specific requirements.

5. Download the Form: Once you’ve identified the correct form, click on the corresponding link. This will open a new window containing a PDF version of the form. Right-click on the form and select “Save as…” to download it.

Adding Value: Exercises to Enhance Understanding

Practice makes perfect, even when applied to administrative tasks like downloading a 1099 form. Consider practicing this process on the IRS website. Take notes, bookmark the page, or even guide someone else through the steps. This activity mimics the iterative process of debugging code, where repetition aids understanding and efficiency.

Explore Other Forms:

Once you master how to download the 1099 form, challenge yourself to explore other tax forms available on the IRS website. This endeavor might appear as straightforward as understanding a well-commented piece of code, but navigating through the plethora of IRS tax forms can greatly enhance your tax literacy.

Remember, just like code optimization in software engineering, becoming efficient in tax management requires practice, precision, and a deep understanding of the system. This guide seeks to provide you with the initial push; the rest is up to your explorative instincts and your desire to de-complicate processes. Happy downloading!

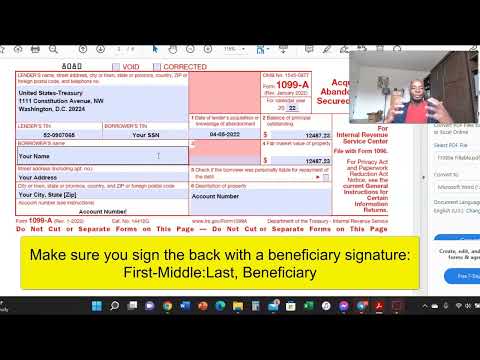

HOW TO BUY A HOUSE OR CAR WITH 1099-A

How To Do Taxes With A 1099 | Form 1099-NEC (If You’re Self-Employed Or A Contractor Watch This!)

How To Fill Out The 1099A Form Debt Discharge Meet Your Strawman Pay Off Bills With Coupon

Can you just print 1099 forms online?

Yes, it is possible to print 1099 forms online. Various software solutions and web-based applications provide this important functionality. These services either facilitate e-filing directly with the IRS or generate form data in a printable format that can be physically mailed to the authorities.

For instance, some popular tax preparation and accounting software like TurboTax, TaxAct, and QuickBooks, allow users to complete and print 1099 forms. Websites such as the IRS official site also provide downloadable PDF versions of these forms that can be printed.

However, always remember that the ‘red-ink’ version of 1099 cannot be printed from your home or office printer. The ‘red-ink’ versions are pre-printed forms used by the IRS and they are not suitable for printers’ ink or toner. Thus, only the black ink copy of Form 1099 should be printed from your software for submission to the IRS.

In conclusion, while printing 1099 forms online is very much feasible with the right software or through the correct IRS-approved websites, it’s crucial to understand the constraints about the color of ink acceptable, avoid printing the ‘red-ink’ version and checking whether your software prints IRS-acceptable copies.

How do I find all my 1099 forms?

If you are seeking your 1099 forms in the context of financial or tax software, it will largely depend on the specific software that you’re using. However, most programs follow a similar process. Here’s a generalized guideline for how to find your 1099 forms:

1. Log in to your software account.

2. Navigate to the “Tax” or “Forms” section. This is typically found within the main dashboard or under an “Income” tab.

3. Look for an area that discusses all forms and click on it. In some cases, this might be labeled as “All Forms,” “Tax Forms,” or “Income Documents.”

4. Within that section, you should see a list of available forms. Find “Form 1099” within this list. There may be different versions of the 1099 form listed, so be sure to select the one relevant to your situation (for instance, 1099-MISC if you’re a freelancer).

5. After clicking on Form 1099, there should be an option to view and/or download the form. If you previously filled out a 1099 with the software, it should have your information saved.

Always remember to consult the help section or contact customer support for your specific software if you’re having trouble finding Form 1099.

How do I print my own 1099?

Printing your own 1099 can be done using tax software apps and online tools. Here’s how you can do it:

Step 1: Purchase the necessary 1099 forms

Before initiating the process, you need to buy the correct forms. You can buy 1099 forms online or at an office supply store. The IRS also provides these forms for free; however, you must order them ahead of time.

Step 2: Install tax preparation software

Software like TurboTax or H&R Block are quite popular for this purpose. Once installed, you will need to choose the correct tax form (1099) within the software.

Step 3: Fill out the 1099 forms

The templates provided by the software make it easy to input your information correctly. Make sure to fill out both copies of the form (one for you and one for the IRS).

Step 4: Print the forms

Once all the information is filled in, the software will allow you to print out your 1099 form.

Remember that you must file the 1099 form with the IRS and send a copy to your contractor or the person you are reporting income for. It’s crucial to note that since this is a tax-related matter, you should consult with a professional or a CPA to avoid any errors and ensure accuracy.

Where can I download a 1099-MISC form?

You can download a 1099-MISC form directly from the Internal Revenue Service’s (IRS) official website. Here is a step-by-step guide on how you can do it:

1. Go to the IRS’s official website at www.irs.gov.

2. Navigate to the “Forms & Instructions” section.

3. Look for the “Search Forms & Instructions” box, type in “1099-MISC,” and hit the search button.

4. Click on the link for the Form 1099-MISC, and you’ll be directed to a page where you can download the form.

5. Click on the “Download” link, and the form should start downloading.

*Note:* Be sure to have a PDF reader installed on your device to view and print the form after downloading. You can download a free PDF reader such as Adobe Acrobat Reader if you do not already have one.

Remember, the IRS recommends using professional tax software to fill out a 1099-MISC form electronically. This ensures you meet the requirements for accuracy and accountability.

Always protect sensitive information when filling out tax forms, either through a secured server or encrypted software.

“What are the steps to download the 1099 form online?”

Downloading a 1099 form online can be straightforward if you follow these steps:

1. Find a reliable source: Many providers online supply 1099 forms. However, the most secure location to download such forms is the official IRS website.

2. Navigate to the IRS website: Open a web browser and go to www.irs.gov

3. Access the Forms & Publications page: On the main navigation bar at the top of the IRS homepage, find the link titled “Forms & Instructions” and click on it.

4. Search for the 1099 form: Once you are on the Forms & Instructions page, you will see a search box. Enter “1099 form” into this box and press enter.

5. Select the correct 1099 form: Several versions of the 1099 form exist, so make sure you choose the one that applies to your tax situation. For example, if you are an independent contractor, you likely need the 1099-NEC.

6. Download the form: After selecting the correct 1099 form, click on the link that says “Download”. The form will open on your screen as a PDF file, which you can then save to your computer or print out as necessary.

Remember to fill out the 1099 form accurately and completely to avoid potential issues with the IRS.

Note: While software solutions are available to handle this process, downloading the form directly from the IRS website is the simplest method and does not require special software.

“Which websites offer a printable version of the 1099 form for free?”

Sure, here’s a response to your request:

Several websites offer a free printable version of the 1099 form. The most reliable source is indeed the Internal Revenue Service (IRS) itself. You can download the form directly from their official website: www.irs.gov.

Another option is TurboTax, a software tool owned by Intuit Consumer Tax Group. This platform offers not only the 1099 form but also helps you fill it out correctly.

Lastly, H&R Block and TaxAct are other reliable online services that offer printable 1099 forms for free. They also come with helpful tips and guidelines on how to properly fill out the form.

Please remember to print these forms on a special type of paper called scannable paper because regular paper won’t scan accurately, causing issues when processing the form.

“What is important to know before downloading the 1099 form from the IRS website?”

Before you download the 1099 form from the IRS website, there are several pertinent points to consider:

1. Compatibility: Ensure your computer meets the minimum system requirements necessary for viewing and downloading the form. The site works best with the most recent version of Adobe Reader or other PDF readers.

2. Internet Connection: A stable internet connection is required to download the form without interruptions.

3. File Format: The 1099 form is typically available in PDF format. Ensure you have the necessary software, such as Adobe Acrobat Reader, to view and print the form.

4. Data Security: The IRS uses robust encryption to protect information on its website. However, it’s still crucial to use a secure network when downloading, and not public Wi-Fi, to prevent unauthorized access to your data.

5. Information Accuracy: Before downloading, ensure you have all the necessary information to accurately fill out the 1099 form. It’s important to include correct details for income, deductions, and credits.

6. Access: Lastly, be aware that access to forms may be limited during peak times due to high demand. Therefore, it’s advisable to download the form well ahead of the tax filing deadline.

“What are the common errors to avoid when downloading the 1099 form?”

Downloading the 1099 form relates more to basic computer skills than specific software, but there are some common errors to avoid.

Error 1: Not Checking Your Internet Connection. Make sure you have a stable internet connection before starting the download process. If your connection is unstable, the download might fail or the file might be corrupted.

Error 2: Downloading from Unreliable Sources. It’s important to download the 1099 form directly from the IRS website or a reliable tax software. Downloading from unknown sources can expose your computer to viruses and malware.

Error 3: Not Updating Your PDF Reader. The 1099 form is typically in PDF format. If you don’t have the latest version of a PDF reader software like Adobe Reader, you might encounter problems opening the form.

Error 4: Ignoring Software Compatibility. Ensure that your operating system and browser support the tax software or website you’re downloading from.

Error 5: Not Checking File Size. Before starting the download, check the file size. If your device doesn’t have enough storage space, the download will fail.

Error 6: Not Saving the File Correctly. After the download, make sure to save the file in a location you can easily find later.

While these tips might seem obvious, they’re easy to overlook. You can avoid frustration and lost time by checking these potential issues before downloading your 1099 form.

“Are there any specific software requirements or web browsers needed for downloading the 1099 form?”

No specific software requirements are needed for downloading a 1099 form. However, a PDF reader such as Adobe Reader is needed to view and print the form. As for web browsers, you can use any mainstream browser like Chrome, Firefox, Safari, or Edge. Just ensure that your browser is updated to its latest version for smooth functionality. Also, check that your browser settings allow for downloads and that they don’t block pop-up windows, which might be used in the download process.