Initiating the H&R Block Journey: From Taxes to Digital Documents

An anecdote often circulates in the mathematics community. It goes like this – “There are three types of mathematicians: those who can count and those who cannot.” This quip, despite its humor, raises a fascinating question about mathematics and its many applications outside the realm of pure theory. One such vital area is income tax calculation.

As mathematicians and statisticians, we often ponder on algorithms and proofs, but when it comes to applying this knowledge to prepare our tax returns, we look for simplicity and precision, don’t we? This article will guide you through the process of answering an important question – “how do I download my tax return from H&R Block?“

Diving into H&R Block: An Introduction

H&R Block, a renowned tax preparation software used worldwide. It streamlines the complex process of tax filing, making it more accessible to non-experts and savants alike. But apart from this primary feature, it also allows users to download their tax returns for future references, a feature that not every user is aware of or knows how to use.

Locating Your Tax Return Document

The first step in downloading your tax return from H&R Block begins with logging into your account. After signing in, navigate to the “Taxes” tab located in the main menu. Here, you’ll find a summary of your previous tax returns. Look for the specific year’s tax return you wish to download.

Downloading Your Tax Return

Once you have located the desired tax return, click on the “Download” link. This will initiate a download process, and your tax return document, usually in the PDF format, will be saved on your computer. It’s as simple as downloading an academic paper or a dataset for your statistical model.

Understanding the Content of Your Downloaded Tax Return

The downloaded tax return encompasses all data that you entered during the tax filing process along with the calculated results. It includes your income details, deductions, credits, and the final tax liability or refund. Essentially, it’s a comprehensive overview of your financial footprint for that tax year.

Why Downloading Your Tax Return is Important

Having an offline copy of your tax return can come handy under numerous circumstances. For instance, it serves as a proof of income when applying for loans or scholarships. In fact, some mathematical scholarships require applicants to submit their tax return to prove their financial need. Besides, maintaining a record of your tax return helps in better financial planning and tax management.

Securing Your Downloaded Tax Return

When it comes to documents as critical as your tax return, security is of utmost importance. Ensure to store it securely, preferably in an encrypted format or a password-protected folder. Consider this akin to securing your mathematical theories and researches – only that, this time, the stakes involve not just intellectual property, but also your financial privacy.

Advanced Tips for H&R Block Users

While the primary focus of this article encompasses the basic process of downloading your tax return from H&R Block, there are few more tips that can enhance your experience with this software. For instance, you can leverage the software to estimate your taxes for the upcoming year and plan your finances accordingly, just as you would strategize the approach to solve a complex mathematical problem.

In conclusion, H&R Block provides an efficient platform to manage your tax filing needs. By following the steps outlined above, you will easily be able to download your tax return from H&R Block. Remember, just like in mathematics, accuracy and attention to detail are pivotal in understanding and managing your taxes. Happy tax managing, fellow mathematicians!

How to File Taxes for Free 2023 | IRS Free File

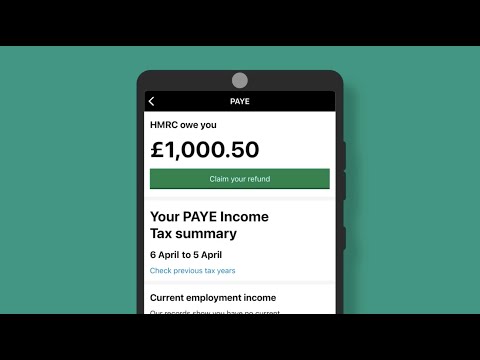

How do I use the HMRC app to claim a tax refund?

how to lodge tax return step by step in Australia | 2022 | tax refund | abn tfn

How can I download my tax return from H&R Block?

You can download your tax return from H&R Block by following these steps:

1. Login to your H&R Block account.

2. Navigate to the “Tax History” section.

3. Find the tax return you want to download and click on “View/Print Return”.

4. Once you’re viewing your return, look for a “Download” or “Print” option, usually represented as an icon.

5. Click the icon to start the downloading process. It will typically be a PDF file that is saved to your device’s downloads folder.

6. Check your downloads folder to ensure the file has been properly downloaded.

Please note: the exact navigation and steps may vary depending on the version of the H&R Block software you are using. If you encounter any issues, it is best to reach out to H&R Block support directly. They’ll be able to guide you through the process specific to your individual circumstances.

How do I download my tax return?

To download your tax return, you will need to follow a few simple steps. Please note that the specific process may vary depending on the tax software you are using.

1. Access your Account: Sign in to your account on your tax software. This could be TurboTax, H&R Block, or any other tax preparation software that you have used.

2. Go to the Tax Section: Navigate to the “Taxes” or “My Tax Forms” section of your account dashboard. This is usually easily accessible from the main menu.

3. Select the Appropriate Tax Year: Select the tax year for which you want to download the return. Most softwares allow you to access tax returns from previous years as well.

4. Download your Tax Return: Look for a “Download” or “Print / Save” button, and click on it to begin the download. The return should be downloaded as a PDF file that you can save to your computer.

Remember to save your files in a secure location since they contain sensitive information.

Can I download a PDF of my tax return?

Yes, definitely. If you are using a tax software, it should allow you to download a PDF of your tax return upon completion. You usually just need to navigate to the summary or overview section of your account and there should be an option there to “Download” or “Print” your return.

Remember, this PDF will contain sensitive information such as your SSN and income details, so make sure to store it securely if you choose to save a copy. If you do not see the option to download your tax return, it would be best to contact the software’s customer support for assistance.

When you download a file from H&R Block Where does it go?

When you download a file from H&R Block, it typically goes to the default download location set up for your web browser. Most often, this is a folder labeled ‘Downloads’ in your computer’s personal files.

If you’re using a Windows computer, this is usually located under ‘This PC’> ‘Downloads’. On a Mac, you’d find it under ‘Go’ > ‘Downloads’ from your desktop.

Remember it also depends on your specific browser settings. Some browsers may ask where to save downloads each time, giving you the option to choose the destination.

It’s important to remember to move critical files like tax documents to a more secure location, such as an encrypted folder or a secure cloud storage service, once they’re downloaded. Remember, the safety of your personal information should always be paramount.

What are the steps to download my tax return from H&R Block?

Sure, here are the steps you need to follow in order to download your tax return from H&R Block:

1. Launch your web browser and navigate to www.hrblock.com.

2. In the top right corner of the homepage, click on “Sign in”.

3. Enter your username and password in the corresponding fields, then click on “Sign in” button.

4. Once you’ve signed in, select “Current Year Tax Return” from the main menu.

5. Under the “Your Tax Returns & Documents” section, choose the tax year for the return you want to download.

6. After selecting the tax year, click on “Download tax return”.

7. The download should start automatically. If it doesn’t, check your browser’s download settings.

Remember, the tax return files are usually in PDF format, so make sure you have a suitable software like Adobe Acrobat Reader to open and view the document.

Can I download a copy of my tax return directly from my H&R Block account?

Yes, you definitely can download a copy of your tax return directly from your H&R Block account. After logging into your account, you’ll have access to the “Tax History” tab. There, you will find all your previous tax return files.

You simply need to click on the specific tax year you are interested in, and there should be an option to “Download Tax Return”. Clicking this will automatically begin downloading a PDF file of your tax return to your computer or device.

Remember to enable pop-ups, as some browsers block downloads that are not triggered by user interaction. Also, make sure you have a PDF reader installed on your device to open the downloaded file.

Always keep your login information safe and private, as your H&R Block account contains sensitive personal information. Change passwords regularly and consider two-factor authentication for added security.

Are there any specific system requirements for downloading my tax return from H&R Block?

Yes, there are specific system requirements for downloading your tax return from H&R Block. You need a computer with either a Windows or Mac operating system. More specifically, the software supports Windows 8.1 or later and Mac OS X 10.13 or later.

You’ll also need an internet connection to download and install the software, and at least 170MB of hard disk space for the program files. The recommended screen resolution is 1024×768 or higher.

The software also requires the latest version of Adobe Reader for viewing and printing your completed returns. It’s important to note that using other PDF viewer software may cause some forms to display incorrectly.

Always ensure your browser is updated to the current version as well, to avoid any technical issues during the procedure.

So, to ensure a smooth and error-free experience when downloading your tax return from H&R Block, make sure you meet all these system requirements.

What should I do if I have trouble downloading my tax return from H&R Block?

If you’re facing issues downloading your tax return from the H&R Block software, follow these troubleshooting steps:

1. Check your internet connection: Ensure you have a stable internet connection as the download process requires it.

2. Update the H&R Block software: Outdated software can often cause problems. Make sure your software is up-to-date.

3. Disable any pop-up blockers: Sometimes, pop-up blockers or firewalls can prevent the download from initiating.

4. Clear your browser cache: If you are using the web version of the software, clearing your browser cache can sometimes resolve the issue.

5. Try a different browser or device: It could be a compatibility problem with your current browser or device. Try using a different browser or accessing the software on a different device.

6. Contact H&R Block support: If none of the above works, it’s best to get in touch with the H&R Block support team. They may be able to provide further assistance or offer an alternative solution.

Is there a certain time frame during which I am able to download my tax return from H&R Block?

With H&R Block’s tax software, you can download your tax return for six years following the completion of your return. This is a feature that H&R Block offers to ensure you have access to your important tax documents whenever needed.

To download, log into your H&R Block account and navigate to the “Tax History” section. Here, you will be able to download your returns in PDF format. It’s essential to keep in mind that, while H&R Block provides this service, it’s always a good practice to save a copy of your tax return for your records once completed.

Please note that availability might depend on whether you used H&R Block’s online services or desktop software. If you cannot find your return, or if it has been more than six years, contacting H&R Block customer service may provide further assistance.